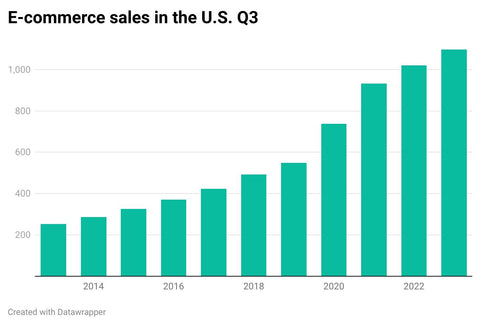

With a 37.8% market share in the U.S. and total sales reaching $143.08 billion in the third quarter of 2023, Amazon retains its place as an industry leader in the e-commerce industry. Below is the takeaway we of the 2023 Report by Marketplace Pulse.

In 2023, e-commerce grew exponentially, reaching a whopping $5.2 trillion globally. There were many positives for Amazon this year with a focus on advertising, logistics, and technology. Likewise, various challenges are plaguing the giant such as social commerce and Chinese competitors.

In this article, we take a step back and evaluate the highlights of 2023 with prominent highlights and opportunities for 2024.

Amazon's Year in a Nutshell

Amazon continued its strong performance in 2023 with a diverse product range, growth of Amazon Prime members, and new revenue streams such as pharmacy. Amazon continued to remain at the forefront of e-commerce in the USA with 2.72 billion unique monthly visitors and high profitability.

At the same time, there were various challenges that Amazon faced in 2023. This includes antitrust laws that pressured Amazon’s business practices and tough competition, especially from Chinese retailers and marketplaces.

Emerging Players in E-commerce

Emerging players from China primarily Shein and Temu pose a significant challenge to Amazon. These apps represent an evolving landscape of e-commerce in the future competing on low prices and customer convenience. With this surge in competition, businesses can rely on a dedicated database of Amazon 3P Sellers to gain a competitive advantage.

China’s Advances in the E-commerce Space

China initially focused on manufacturing and wholesale with little interest in retail. In the last decade, the focus shifted from only manufacturing to Chinese sellers actively selling on different platforms including Amazon. This move increased the market share of Chinese sellers in the U.S.

Presently, China has shifted its focus on selling through its marketplace without relying on third-party e-commerce stores. Shein and especially Temu are achieving this more successfully than their predecessors AliExpress and Wish. Both Shein and Temu are expanding in the U.S. and major economies, forcing Amazon and its sellers to answer back.

1. Shein

Unlike Amazon, Shein is not a marketplace but only a retailer, meaning that it sells products itself. Shein’s core specialty is in fast fashion and clothing with sales reaching more than $30 billion in 2023. The platform can compete with established names like H&M and Zara with its huge online presence and various discounts and promotions.

Amazon was forced to reduce its referral fees from 17% to 10% for low-value items (<$15) and from 17% to 5% for medium-value items (between $15 - $20).

2.Temu

Temu is a Chinese marketplace launched in 2022 that took the world by storm with more than 80 million users by the end of 2023. With more than 100 million downloads, Temu has a huge market in the U.S. and the U.K. with many users finding the service cost-friendly and convenient.

Temu has aggressively expanded overseas by leveraging China’s manufacturing might and can hurt local sellers with its current rate of penetration. With growing competition, finance and lending companies have a golden opportunity to invest in sellers and marketplaces offering the best ROI with lower risk.

Aggressive Marketing by Chinese Marketplaces

Chinese marketplaces are aggressively marketing their platforms with billions of dollars in advertising. This has seemed to work with Shein and Temu being among the most downloaded apps in the U.S. each day in 2023. Both platforms are advertising on various social media channels, influencer sponsorships, and affiliate partnerships to attract customers. These platforms are also using data-driven techniques to create personalized recommendations and targeted campaigns to engage customers and beat out the competition.

Unlike their competitors, these marketplaces generate most of their orders through mobile apps, allowing them to leverage the increase in smartphones and internet accessibility to their advantage. Businesses interested in targeting mobile users can use a comprehensive Amazon 3P seller list to gain a competitive edge and target audiences more effectively.

Rise Of 3P Sellers

Amazon 3P Sellers make up 60% of Amazon’s sales and sum up to 2.5 million sellers worldwide. Amazon 3P Sellers have gradually increased on Amazon’s network with their share of sales increasing from 2007 to 2023. The marketplace segment has grown at a stable rate in the last decade with sales by the retail team slowly diminishing.

3P Sellers enjoy more control over their product including pricing and marketing making them a better alternative to 1P Vendors. With this increase in 3P sellers, a list of Amazon sellers can provide meaningful insights for analysis and decision-making.

3P Sellers Cost Breakdown

With the boom in E-commerce, many outsiders look at 3P Selling as a gold mine. However, there are many costs associated with selling including the referral fee which on average is 50% (raised from 35%) a few years ago.

This includes a 15% transaction fee (also known as referral fee), 20-35% fulfillment by Amazon (FBA) cost, and a further 10-15% on marketing and advertising, according to Market Pulse. The transaction fee is the only fee that hasn’t changed in the last 10 years and it varies by the category of product being sold.

Finer Details For 3P Sellers

Both FBA and marketing are non-mandatory options for 3P sellers on paper. However, in practice, it is quite difficult to rank your product and increase your revenue without these options. Amazon’s FBA is a one-in-all solution where Amazon takes care of most logistics making it the make-or-break factor for many sellers.

Similarly, with the cut-throat competition in the E-commerce space, aggressive marketing on Amazon, Meta, and other platforms ensures brand visibility and higher conversion. Likewise, by leveraging the Amazon seller database, SaaS entities can offer integrated solutions such as analytics and forecasting to Amazon sellers.

If you’re looking for reliable databases that can skyrocket your revenue potential, check our Amazon 3P seller databases.

Use of Omnichannel By 3P Sellers

With increasing competition, many 3P Sellers are utilizing omnichannel to improve product visibility and boost sales. This is achieved by using other mediums such as social media platforms, websites, blogs, video platforms, and even physical stores to deliver an integrated and convenient customer experience.

Omnichannel can yield several benefits for 3P sellers including higher brand prominence, more customer engagement, and increased revenues. These businesses can also gain more customers by using a database of Amazon 3P US sellers to target relevant clients more effectively.